Samsung and SK Hynix cease supply of DDR3, boosting prices by 20%.

Samsung and SK Hynix cease supply of DDR3, boosting prices by 20%

According to reports from China's Taiwan Economic Daily cited by the Science and Technology Innovation Board Daily, it is rumored in the industry that the world's top two DRAM suppliers, Samsung and SK Hynix, are vigorously pushing for high-bandwidth memory (HBM) and mainstream DDR5 memory specifications. Starting from the year's second half, they will halt the supply of DDR3 niche-type DRAM, triggering a rush in the market and causing recent DDR3 prices to skyrocket by up to 20%. Moreover, prices are expected to rise even further in the year's second half.

Infineon announces austerity measures: lowers full-year expectations and lays off employees.

According to reports cited by the foreign media SemiMedia, influenced by the sustained weakness in demand in the semiconductor industry, Infineon recently announced austerity measures, lowering its full-year revenue forecast and laying off employees at its Regensburg factory.

As per the austerity measures, Infineon has revised its revenue guidance for 2024 to €15.1 billion, plus or minus €400 million, which is lower than the previous guidance of €16 billion. Infineon stated that the departmental performance profit margin may also be lower than forecasted three months ago, at around 20%. Infineon CEO Jochen Hanebeck remarked that many end markets are affected by economic conditions, with customers and distributors continuing to reduce inventory levels. Additionally, growth in the automotive industry has significantly slowed down.

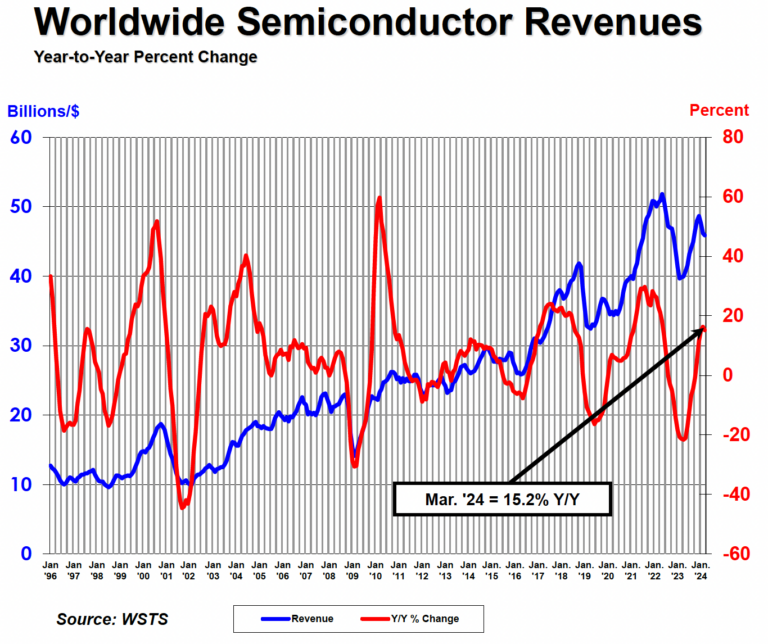

SIA: Global semiconductor sales reached $137.7 billion in the first quarter, up 15.2% year-on-year

According to data released by the Semiconductor Industry Association (SIA), global semiconductor sales totaled $137.7 billion in the first quarter of 2024, representing a year-on-year increase of 15.2% but a 5.7% decrease compared to the previous quarter. Sales for March 2024 decreased by 0.6% compared to February 2024.

Source-SIA

SIA CEO John Neuffer stated that global semiconductor sales in the first quarter were significantly higher than the first quarter of the previous year, but there was a slight decline in sales both sequentially and quarter-on-quarter, reflecting normal seasonal trends. The market is expected to continue to grow for the remainder of the year, with double-digit annual growth projected for 2024.

Wuhan Newcore Semiconductor initiates IPO counseling, formerly a subsidiary of Yangtze Memory Technologies

According to reports cited by Fast Technology, Wuhan Newcore Integrated Circuit Co., Ltd. recently disclosed an IPO counseling filing with the Hubei Securities Regulatory Bureau, indicating that Wuhan Newcore is advancing its listing process. According to the IPO counseling filing, its controlling shareholder is Yangtze Memory Technologies Holding Co., Ltd., with a holding ratio as high as 68.1937%.

It is understood that Wuhan Newcore is an integrated circuit manufacturing company specializing in NOR Flash storage chips, with the first 12-inch integrated circuit production line project in central China. The company achieved a turnaround from loss to profit at the end of 2017 and announced the full-scale production of its self-developed 50-nanometer SPI NOR Flash chips in 2020. Wuhan Newcore was previously a wholly-owned subsidiary of Yangtze Memory. In early March this year, the company announced its first external financing, increasing its registered capital from about RMB 5.782 billion to about RMB 8.479 billion.

A Comprehensive Guide to Grasping FPGA Structure6/20/2024 762

A Comprehensive Guide to Grasping FPGA Structure6/20/2024 762FPGA (Field-Programmable Gate Array) is an integrated circuit, a type of programmable chip, that allows engineers to program custom digital logic. It can change its hardware logic based on the program, with the primary purpose of enabling engineers to redesign and reconfigure their chips faster and cheaper, whenever they want. However, nothing in the world is ideal, and FPGA chips also have limitations!

Read More > The EU to Impose Tariffs on Electric Vehicle Imports from China in Early July6/17/2024 387

The EU to Impose Tariffs on Electric Vehicle Imports from China in Early July6/17/2024 387The EU to Impose Tariffs on Electric Vehicle Imports from China in Early July

Read More > What is XC7A100T-2FG484I?6/6/2024 557

What is XC7A100T-2FG484I?6/6/2024 557XC7A100T-1CSG324C is an FPGA-based digital signal processing board, which consists of Xilinx's Virtex-7 series chips and FPGA interface chips.

Read More > Analog cycle inventory hits bottom, AI drives flash memory demand to continue6/4/2024 570

Analog cycle inventory hits bottom, AI drives flash memory demand to continue6/4/2024 570Analog cycle inventory hits bottom, AI drives flash memory demand to continue

Read More >

Hot News

- Electronic Component Symbols: Resistor, Capacitor, Transformers and Connectors

- Diode Overview: Application in Automotive Alternator Rectifiers

- Voltage-Controlled Oscillator: Principle, Type Selection, and Application

- Ultra-low power consumption of STM32U575/585 microcontrollers(MCU)

- What is Xilinx 7 Series FPGA Clock Structure- -Part two

- Zedboard zynq-7000: Zynq 7000 datasheet, Features, Architecture and Core Components