Analog cycle inventory hits bottom, AI drives flash memory demand to continue

Brokerage: This round of global analog chip inventory cycle has bottomed out

According to Cailianshe, the CITIC Securities Research Report stated that after nearly six quarters of adjustment, combined with the first quarter report data of seven major analog chip companies in Europe and the United States, as well as the companies' public statements, CITIC Securities judged that this round of global analog chip inventory cycle has bottomed out. Standing at the starting point of a new round of cycles, it is recommended to actively allocate US stock analog chip sectors.

The semiconductor cycle repeats itself, but each time is different. Compared with the previous cycle, the recovery rhythm of corporate gross profit margin in this cycle is expected to be relatively slow, but the upward range and duration of the cycle are expected to be significantly better than the previous cycle. In the medium and short term, CITIC Securities prefers the Fab-lite model and companies whose downstream customers are mainly in high-end markets such as industry and automobiles.

Research: AI servers drive NAND flash memory market growth, which will continue in the second quarter

According to the Taiwan Business Times, AI servers have expanded the use of enterprise-level SSDs since February, and large-capacity orders have begun to emerge. PC and smartphone customers have also increased their inventory levels in response to price increases, driving the price and volume of NAND flash memory to rise in the first quarter of 2024, with revenue increasing by 28.1% quarter-on-quarter to US$14.71 billion.

Observing the trend in the second quarter, the NAND flash memory inventory level of PC and smartphone customers is already high, and the growth of consumer terminal orders in 2024 has not exceeded expectations, so brand manufacturers' buyers have become more conservative in the stocking. At the same time, thanks to the doubling of large-capacity enterprise-level SSD orders, the average price of NAND flash memory products in the second quarter continued to rise by 15%, and it is estimated that NAND flash memory revenue in the second quarter has the opportunity to increase by nearly 10% quarter-on-quarter.

Institution: Global wafer foundry revenue increased by 12% year-on-year in the first quarter

According to Cailianshe, according to Counterpoint Research's "Wafer Foundry Quarterly Tracking" report, the global wafer foundry industry revenue in the first quarter of 2024 fell 5% month-on-month and increased 12% year-on-year.

The month-on-month decline is not only due to seasonal factors but also affected by the slow recovery of non-AI chip demand such as smartphones, consumer electronics, the Internet of Things, automotive and industrial applications. This trend is consistent with TSMC management's observations on the slow recovery of non-AI demand. Therefore, TSMC lowered its growth forecast for the logic chip industry in 2024 from more than 10% to 10%.

SK Hynix will introduce MOR photoresist in next-generation DRAM

According to Korean media TheElec, SK Hynix plans to use Japan's Inpria's metal oxide resist photoresist (MOR) in the production of 10nm 6th-generation 1c process DRAM. Sources said that SK Hynix's 1c DRAM has five EUV layers, one of which will be drawn using MOR. At the same time, Samsung is also considering using Inpria's MOR in its 1c DRAM.

MOR is considered to be the next-generation chemical amplified resist (CAR) currently used for advanced chip lithography. CAR faces limitations in PR resolution, etching resistance, and line edge roughness. Companies such as Inpria and Lam Research are working to develop inorganic PRs such as MOR to overcome current limitations.

MediaTek Dimensity 9400 debuts Arm X925 super-core processor

According to Fast Technology, blogger Digital Chat Station revealed that MediaTek Dimensity 9400 is the first to launch Arm Cortex-X925 super-core, which will be MediaTek's most powerful mobile phone chip. The Cortex-X925 super-core performance is 36% higher than X4, and the AI performance is 41% higher. Dimensity 9400 also integrates the new Immortalis-G925 GPU, which has a 37% performance improvement over G720, a 30% reduction in power consumption, and a 52% improvement in ray tracing performance.

In terms of terminals, the vivo X200 series will be the world's first to launch the Dimensity 9400, and the OPPO Find X8 series will also use this processor.

DC-DC converter RFB-0505S: Specification,Datasheet,Features and Applications6/13/2024 41

DC-DC converter RFB-0505S: Specification,Datasheet,Features and Applications6/13/2024 41The RFB-0505S is a DC-DC converter from RECOM Power, Inc., belonging to the RFB Series. It features a Single In-Line Package (SIP7) and provides a single unregulated output. This converter offers 1 watt of power with an output voltage of 5V and is rated for an isolation voltage of 1kV.

Read More > Understanding the RFMM-0505S DC-DC Converter: A Comprehensive Guide6/4/2024 105

Understanding the RFMM-0505S DC-DC Converter: A Comprehensive Guide6/4/2024 105In the world of electronics, ensuring efficient power management is crucial for the performance and reliability of devices. One of the key components in achieving this is the DC-DC converter. Today, we dive into the specifics of the RFMM-0505S DC-DC converter, exploring its features, applications, and benefits.

Read More > 12V DC-DC Converter AM2G-0512SZ: Specifications, Datasheet, Applications and Features6/3/2024 91

12V DC-DC Converter AM2G-0512SZ: Specifications, Datasheet, Applications and Features6/3/2024 91A DC-DC converter is an essential electronic device to convert a direct current (DC) source from one voltage level to another. These converters are widely employed in various applications, including portable electronic devices, automotive systems, and renewable energy installations.

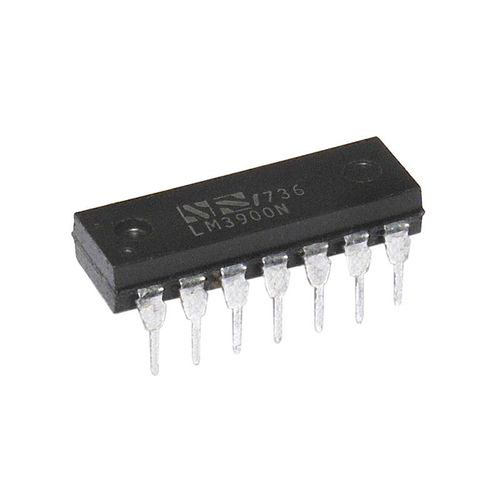

Read More > What is LM3900 Quadruple Norton Operational Amplifier?5/30/2024 127

What is LM3900 Quadruple Norton Operational Amplifier?5/30/2024 127The LM3900 consists of four independent dual-input internally compensated amplifiers. These amplifiers are specifically designed to operate on a single power supply voltage and provide a large output voltage swing. They utilize current mirrors to achieve in-phase input functionality. Applications include AC amplifiers, RC active filters, low-frequency triangle waves, square wave, and pulse waveform generation circuits, tachometers, and low-speed, high-voltage digital logic gates.

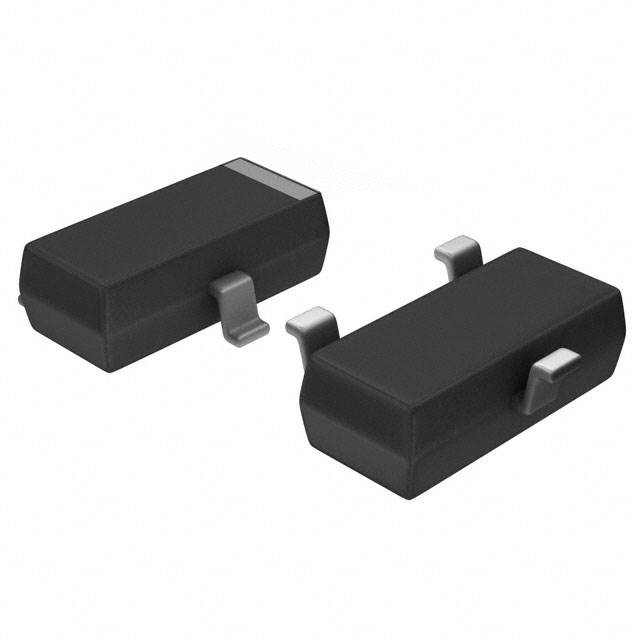

Read More > Exploring the MMBT3906 Transistor: A Comprehensive Guide5/24/2024 85

Exploring the MMBT3906 Transistor: A Comprehensive Guide5/24/2024 85The goal of the Taiwan Semiconductor MMBT3906 PNP Bipolar Transistor is to provide a high surge current capability with minimal power loss. This transistor is perfect for automated installation and has high efficiency.

Read More >