HBM production capacity is squeezing out-DRAM memory may be in short supply in the second half of the year

By the end of the year, HBM’s wafer production will account for 40% of the total DRAM.

According to Cailian News, TrendForce research shows that the three major original manufacturers have begun to increase the production of advanced processes. Following the increase in memory contract prices, the company's capital investment has begun to grow, and production capacity improvements will be concentrated in the second half of this year. It is expected that 1alpha nm (including ) The above wafer production will account for approximately 40% of the total DRAM wafer production by the end of the year.

Among them, HBM has the highest priority in production due to its good profit performance and continued growth in demand. However, the yield rate is only about 50%-60%, and the wafer area is enlarged by more than 60% compared to DRAM products, which means that it accounts for a high proportion of wafer production. Judging from the production capacity of each TSV, HBM will account for 35% of the advanced process by the end of the year, and the rest will be used to produce LPDDR5(X) and DDR5 products.

HBM production capacity is squeezed, and DRAM may be in short supply in the second half of the year

According to China Taiwan Business Times, Samsung, SK Hynix and Micron are all actively investing in high-bandwidth memory (HBM) processes. Legal persons said that due to the effect of capacity crowding, DRAM products may be in short supply in the second half of the year. Nanya, ADATA, and TEAMGROUP are expected to Other businesses will benefit.

Due to HBM's good profit performance and continued growth in demand, production is prioritized. Judging from the latest development progress of HBM, HBM3e will become the mainstream in the market in 2024, with shipments concentrated in the second half of 2024. This period is also the peak season for memory demand, and the demand for DDR5 and LPDDR5(X) is also expected to increase. As HBM's proportion of wafer production expands, output will be limited, and production capacity allocation in the second half of the year will be the key to sufficient supply.

Memory module factory inventories peaked in the first quarter

According to the Taiwan Electronic Times quoted by the Science and Technology Innovation Board Daily, although the demand for consumer electronics products is weak, high-end applications such as AI and cloud servers are in short supply, which continues to drive up contract market prices. The upstream memory market is optimistic that the increase is expected to continue until 2025. Memory module factories are actively stocking up. As of the first quarter of 2024, the inventory amount has reached a high point, and the inventory turnover days of each company are approximately 6-8 months.

TSMC CoWoS advanced packaging production capacity is in short supply

According to Kuai Technology news, the demand for GPUs in data centers has surged, especially the sharp increase in demand for AI chips such as Nvidia H100, causing TSMC to face a production capacity crisis in CoWoS advanced packaging technology. To cope with this challenge, TSMC plans to increase its packaging production capacity in 2024 comprehensively. It is expected that the monthly production capacity will reach 40,000 pieces by the end of the year, an increase of at least 150% compared with 2023.

At the same time, TSMC is already planning its CoWoS production capacity plan for 2025, and it is expected that the production capacity may be doubled, of which Nvidia's demand accounts for more than half. However, a key bottleneck in CoWoS packaging technology is the HBM chip. The number of stacking layers of HBM3/3E will increase from 4 to 8 layers in HBM2/2E to 8 to 12 layers. In the future, HBM4 will increase to 16 layers, which will undoubtedly increase The complexity and difficulty of encapsulation.

Apple executives are rumored to visit TSMC to book all initial 2nm production capacity

According to IT House, Apple Chief Operating Officer Jeff Williams visited TSMC yesterday. The latest news is that the two parties held a "secret meeting" and Apple will acquire all of TSMC's initial 2-nanometer process production capacity.

TrendForce revealed that Wei Zhejia personally received Apple executives during their visit to TSMC. Apple's low-key visit is to secure TSMC's advanced manufacturing capabilities, possibly its 2-nanometer process, for Apple's in-house artificial intelligence chips.

Forecast: RISC-V architecture will occupy 25% of the market share in 2030

According to IT House news, the analysis agency Omdia released a new report stating that the RISC-V architecture is expected to occupy 25% of the market share in 2030. India expects RISC-V-based chip shipments to "increase 50% annually" starting this year, reaching 17 billion chip shipments in 2030. The most widely used industry for RISC-V will be industrial, which is expected to account for 46% of sales; the automotive industry will see the fastest growth, and related architecture chip shipments are expected to grow by 66% annually.

The analysis highlights the advantages of RISC-V for the automotive industry. In terms of business model, X86 is a closed instruction architecture with the highest power consumption; Arm is not as scalable as X86 but has an average energy consumption, while the RISC-V architecture has streamlined instructions and no history. It has the lowest power consumption and can improve the overall performance of the automotive system and reduce manufacturing costs.

DC-DC converter RFB-0505S: Specification,Datasheet,Features and Applications6/13/2024 41

DC-DC converter RFB-0505S: Specification,Datasheet,Features and Applications6/13/2024 41The RFB-0505S is a DC-DC converter from RECOM Power, Inc., belonging to the RFB Series. It features a Single In-Line Package (SIP7) and provides a single unregulated output. This converter offers 1 watt of power with an output voltage of 5V and is rated for an isolation voltage of 1kV.

Read More > Understanding the RFMM-0505S DC-DC Converter: A Comprehensive Guide6/4/2024 105

Understanding the RFMM-0505S DC-DC Converter: A Comprehensive Guide6/4/2024 105In the world of electronics, ensuring efficient power management is crucial for the performance and reliability of devices. One of the key components in achieving this is the DC-DC converter. Today, we dive into the specifics of the RFMM-0505S DC-DC converter, exploring its features, applications, and benefits.

Read More > 12V DC-DC Converter AM2G-0512SZ: Specifications, Datasheet, Applications and Features6/3/2024 91

12V DC-DC Converter AM2G-0512SZ: Specifications, Datasheet, Applications and Features6/3/2024 91A DC-DC converter is an essential electronic device to convert a direct current (DC) source from one voltage level to another. These converters are widely employed in various applications, including portable electronic devices, automotive systems, and renewable energy installations.

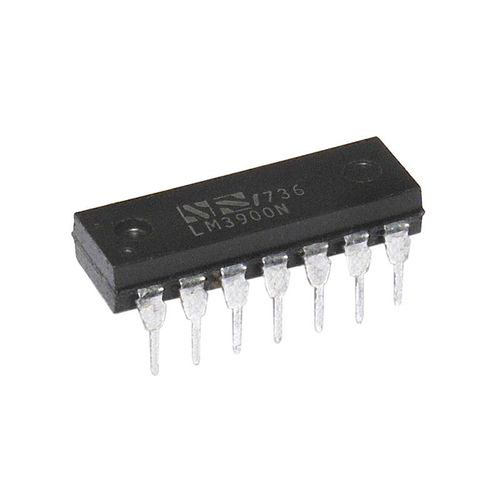

Read More > What is LM3900 Quadruple Norton Operational Amplifier?5/30/2024 127

What is LM3900 Quadruple Norton Operational Amplifier?5/30/2024 127The LM3900 consists of four independent dual-input internally compensated amplifiers. These amplifiers are specifically designed to operate on a single power supply voltage and provide a large output voltage swing. They utilize current mirrors to achieve in-phase input functionality. Applications include AC amplifiers, RC active filters, low-frequency triangle waves, square wave, and pulse waveform generation circuits, tachometers, and low-speed, high-voltage digital logic gates.

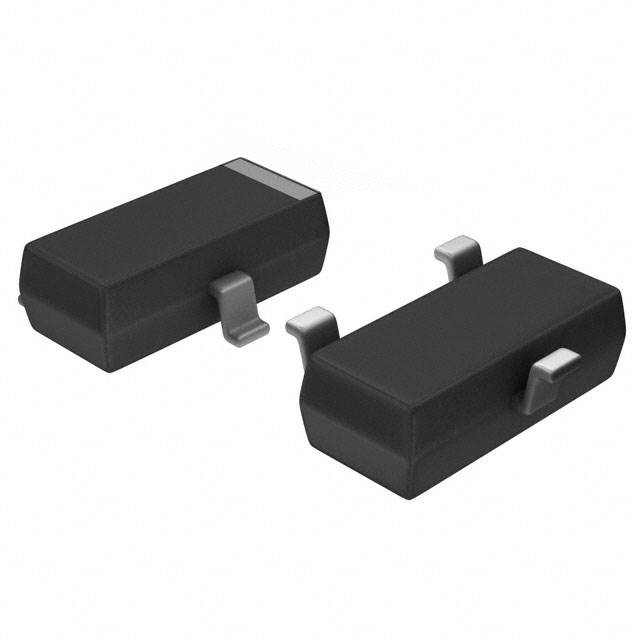

Read More > Exploring the MMBT3906 Transistor: A Comprehensive Guide5/24/2024 85

Exploring the MMBT3906 Transistor: A Comprehensive Guide5/24/2024 85The goal of the Taiwan Semiconductor MMBT3906 PNP Bipolar Transistor is to provide a high surge current capability with minimal power loss. This transistor is perfect for automated installation and has high efficiency.

Read More >