The EU to Impose Tariffs on Electric Vehicle Imports from China in Early July

The EU to Impose Tariffs on Electric Vehicle Imports from China in Early July

According to Caixin, the EU will impose an additional 38.1% tariff on electric vehicle imports from China starting next month. The European Commission announced on June 12 that if a resolution cannot be reached with China, the tariffs will be implemented around July 4. The European Commission stated that BYD, Geely, and SAIC will face tariffs of 17.4%, 20%, and 38.1% respectively; other manufacturers will be subject to a 21% tariff; and Tesla cars imported from China may be subject to a separate rate.

Broadcom's Revenue Grows by 40% Year-on-Year, Raises Full-Year Guidance

Broadcom recently released its financial report for the second quarter of fiscal year 2024 (ending May 5), with revenue of $12.487 billion, a year-on-year increase of 43%. GAAP net profit was $2.121 billion, a year-on-year decrease of 39%. Operating cash for the second quarter was $4.58 billion, and after deducting $1.32 billion in capital expenditures, generated $4.448 billion in free cash flow, accounting for 36% of revenue.

Hock Tan, President and CEO of Broadcom Inc. stated that Broadcom's second-quarter performance was again driven by artificial intelligence demand and VMware. This quarter, AI product revenue reached a record $3.1 billion. As more and more enterprises adopt the VMware software stack to build private clouds, infrastructure software revenue has accelerated growth. Broadcom has raised its full-year fiscal 2024 consolidated revenue guidance to $51 billion and adjusted EBITDA to 61% of revenue

TrendForce: Wafer foundry revenue slightly declined in Q1, SMIC rose to third place

According to news from Fast Technology, a TrendForce survey revealed that in the first quarter of 2024, the total revenue of the world's top ten wafer foundries decreased by 4.3% quarter-on-quarter to $29.2 billion. Benefiting from orders for consumer inventory replenishment and domestic trends, SMIC (Semiconductor Manufacturing International Corporation) ranked third for the first time, surpassing GlobalFoundries and UMC (United Microelectronics Corporation), with a market share of 5.7% and a quarterly revenue increase of 4.3% to $1.75 billion, performing better than other competitors.

TSMC's (Taiwan Semiconductor Manufacturing Company) revenue decreased by 4.1% year-on-year to $18.85 billion, holding a market share of 61.7% and ranking first. Samsung's revenue decreased by 7.2% quarter-on-quarter to $3.36 billion, maintaining an 11% market share and ranking second. UMC and GlobalFoundries ranked fourth and fifth, with 5.7% and 5.1% market shares, respectively. Also among the top ten were Hua Hong Semiconductor, Tower Semiconductor, PSMC (Powerchip Semiconductor Manufacturing Corporation), Hefei Jinghe, and VIS (Vanguard International Semiconductor).

Major manufacturers stop supplying, and the effect of the DDR3 price increase will be apparent

According to the Science and Technology Innovation Board Daily, citing the Taiwan Economic Daily, the insufficient DDR3 production capacity is even more serious. As major manufacturers such as Samsung withdraw from DDR3 manufacturing, the demand for DDR3 in terminal devices such as AI and edge computing continues to increase, and the capacity of a single device rises sharply, which will trigger a rebound in DDR3 prices.

Industry analysis shows that as the production cuts of major DRAM manufacturers continue to ferment, the price of standard DRAM has risen from the second half of 2023 to the present, and the subsequent rise is still expected. The cost of niche memory such as DDR3 will be one to two quarters later than that of standard DRAM, for manufacturers such as Winbond, Jinghao Technology, and Etron that focus on DDR3, the effect of the DDR3 price increase will gradually appear in this quarter and next quarter.

Texas Instruments launches the industry's first GaN intelligent power module

Texas Instruments (TI) has recently launched the industry's first 650V three-phase GaN intelligent power module (IPM) for 250W motor drive applications. The new GaN IPM solves many design and performance trade-offs that engineers typically face when designing major home appliances and HVAC systems. The DRV7308 GaN IPM achieves more than 99% inverter efficiency, optimized acoustic performance, reduced solution size, and lower system cost.

The DRV7308 uses GaN technology to provide more than 99% efficiency and improve thermal performance, reducing power losses by 50% compared to existing solutions. The DRV7308 starts at $5.50 in quantities of 1,000 units and is available in a 12 mm by 12 mm, 60-pin quad flat no-lead (QFN) package. The DRV7308EVM evaluation module is priced at $250.

DC-DC converter RFB-0505S: Specification,Datasheet,Features and Applications6/13/2024 57

DC-DC converter RFB-0505S: Specification,Datasheet,Features and Applications6/13/2024 57The RFB-0505S is a DC-DC converter from RECOM Power, Inc., belonging to the RFB Series. It features a Single In-Line Package (SIP7) and provides a single unregulated output. This converter offers 1 watt of power with an output voltage of 5V and is rated for an isolation voltage of 1kV.

Read More > Understanding the RFMM-0505S DC-DC Converter: A Comprehensive Guide6/4/2024 120

Understanding the RFMM-0505S DC-DC Converter: A Comprehensive Guide6/4/2024 120In the world of electronics, ensuring efficient power management is crucial for the performance and reliability of devices. One of the key components in achieving this is the DC-DC converter. Today, we dive into the specifics of the RFMM-0505S DC-DC converter, exploring its features, applications, and benefits.

Read More > 12V DC-DC Converter AM2G-0512SZ: Specifications, Datasheet, Applications and Features6/3/2024 104

12V DC-DC Converter AM2G-0512SZ: Specifications, Datasheet, Applications and Features6/3/2024 104A DC-DC converter is an essential electronic device to convert a direct current (DC) source from one voltage level to another. These converters are widely employed in various applications, including portable electronic devices, automotive systems, and renewable energy installations.

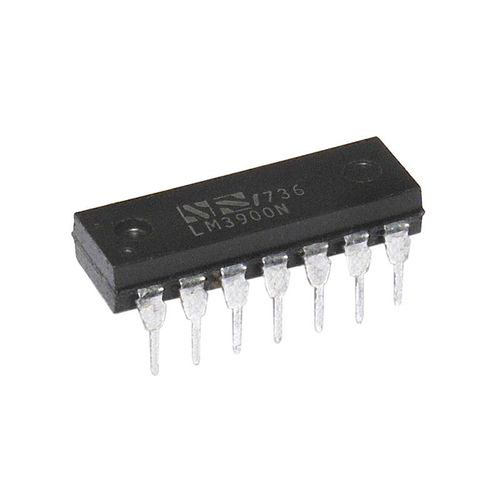

Read More > What is LM3900 Quadruple Norton Operational Amplifier?5/30/2024 146

What is LM3900 Quadruple Norton Operational Amplifier?5/30/2024 146The LM3900 consists of four independent dual-input internally compensated amplifiers. These amplifiers are specifically designed to operate on a single power supply voltage and provide a large output voltage swing. They utilize current mirrors to achieve in-phase input functionality. Applications include AC amplifiers, RC active filters, low-frequency triangle waves, square wave, and pulse waveform generation circuits, tachometers, and low-speed, high-voltage digital logic gates.

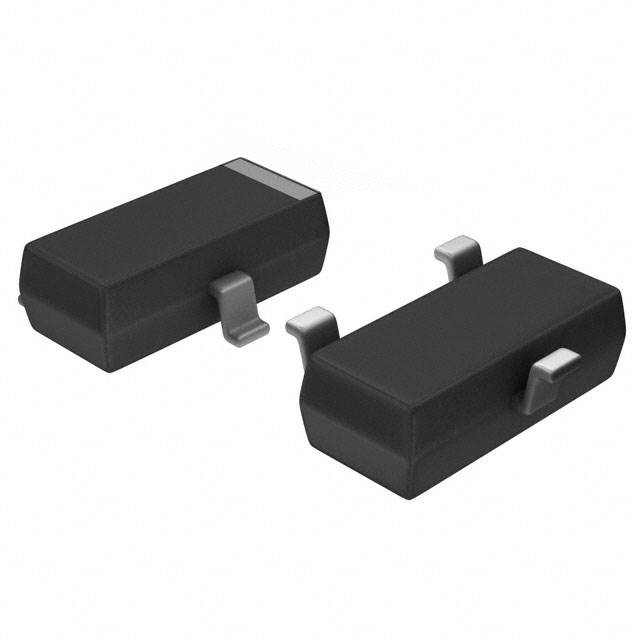

Read More > Exploring the MMBT3906 Transistor: A Comprehensive Guide5/24/2024 104

Exploring the MMBT3906 Transistor: A Comprehensive Guide5/24/2024 104The goal of the Taiwan Semiconductor MMBT3906 PNP Bipolar Transistor is to provide a high surge current capability with minimal power loss. This transistor is perfect for automated installation and has high efficiency.

Read More >